Borrowing Money Made Easy with the Brigit App: A Comprehensive Guide

In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals in need of quick cash solutions. The Brigit app offers a seamless and user-friendly way to borrow money, helping you navigate financial challenges with ease. This guide will provide an in-depth look at how the Brigit app can assist you in borrowing money swiftly and efficiently.

What is the Brigit App?

The Brigit app is a financial wellness tool designed to help users manage their finances, avoid overdraft fees, and access small loans when needed. With its intuitive interface and powerful features, Brigit aims to provide a safety net for those times when you need a little extra cash to get by.

Key Features of the Brigit App

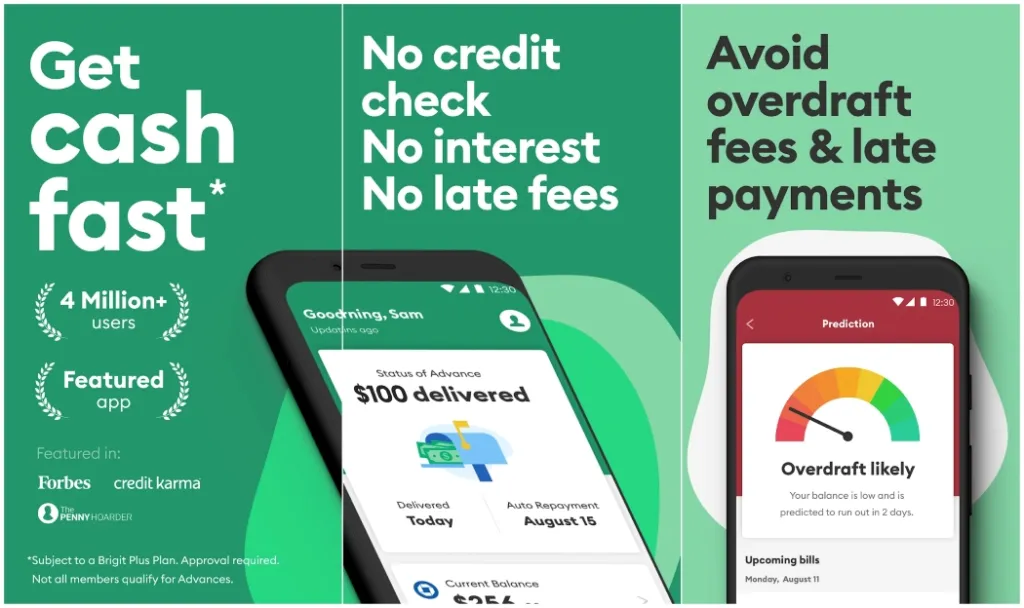

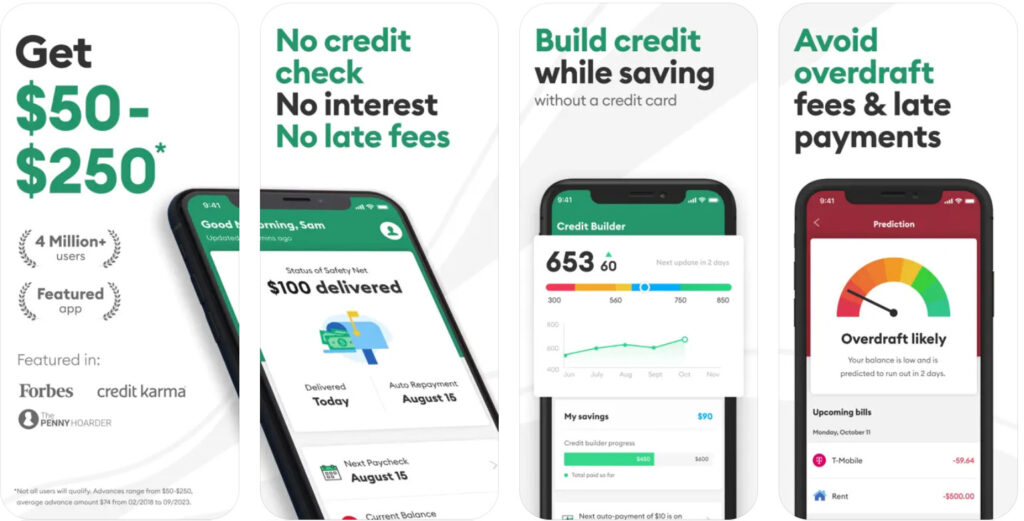

Instant Cash Advances: One of the standout features of Brigit is its ability to provide instant cash advances. Users can borrow up to $250 without the hassle of credit checks or lengthy approval processes.

Overdraft Protection: Brigit helps you avoid costly overdraft fees by alerting you when your balance is low and offering advances to cover potential shortfalls.

Credit Builder: Brigit also offers a credit builder feature, helping you improve your credit score by reporting your timely repayments to major credit bureaus.

Budgeting Tools: The app includes budgeting tools that allow you to track your spending, manage bills, and set financial goals.

How to Borrow Money Using the Brigit App

Borrowing money through the Brigit app is straightforward and user-friendly. Here’s a step-by-step guide on how to get started:

1. Download and Install the App

First, download the Brigit app from the App Store or Google Play Store. The installation process is quick and easy, allowing you to set up your account in just a few minutes.

2. Create an Account

Once the app is installed, you’ll need to create an account. Provide basic information such as your name, email address, and phone number. You’ll also need to link your bank account to enable cash advances and overdraft protection.

3. Verify Your Income

Brigit requires users to verify their income to determine eligibility for cash advances. This involves connecting the app to your bank account and providing proof of regular income deposits.

4. Request a Cash Advance

After your income is verified, you can request a cash advance. Simply navigate to the “Cash Advance” section of the app, select the amount you need, and confirm your request. Funds are typically deposited into your linked bank account within minutes.

5. Repay the Advance

Repaying your cash advance is hassle-free. Brigit automatically withdraws the advance amount from your bank account on your next payday. You can also repay manually through the app if you prefer.

Benefits of Using the Brigit App

No Hidden Fees: Brigit is transparent about its fees, with no hidden charges or interest rates. Users pay a small monthly membership fee for access to the app’s features.

No Credit Check: Borrowing money through Brigit does not require a credit check, making it accessible to individuals with varying credit scores.

Quick and Convenient: The entire process, from requesting an advance to receiving funds, is quick and convenient, often taking just a few minutes.

Financial Wellness: Beyond borrowing, Brigit offers tools and resources to help you manage your finances more effectively, promoting overall financial wellness.

Conclusion

The Brigit app is a valuable tool for anyone in need of quick cash solutions or looking to improve their financial health. With its user-friendly interface, instant cash advances, and comprehensive financial tools, Brigit stands out as a reliable and efficient option for borrowing money. Download the Brigit app today and take control of your financial future.

Not what you’re looking for? Or, looking for more? Check out this article on the Earnin App!